Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Use This Simple Business Plan Outline to Organize Your Plan

12 min. read

Updated April 10, 2024

When starting a business, having a well-thought-out business plan prepared is necessary for success. It helps guide your strategy and prepares you to overcome the obstacles and risks associated with entrepreneurship. In short, a business plan makes you more likely to succeed.

However, like everything in business, starting is often the hardest part. What information do you need? How in-depth should each section be? How should the plan be structured?

All good questions that you can answer by following this business plan outline.

What is a business plan outline?

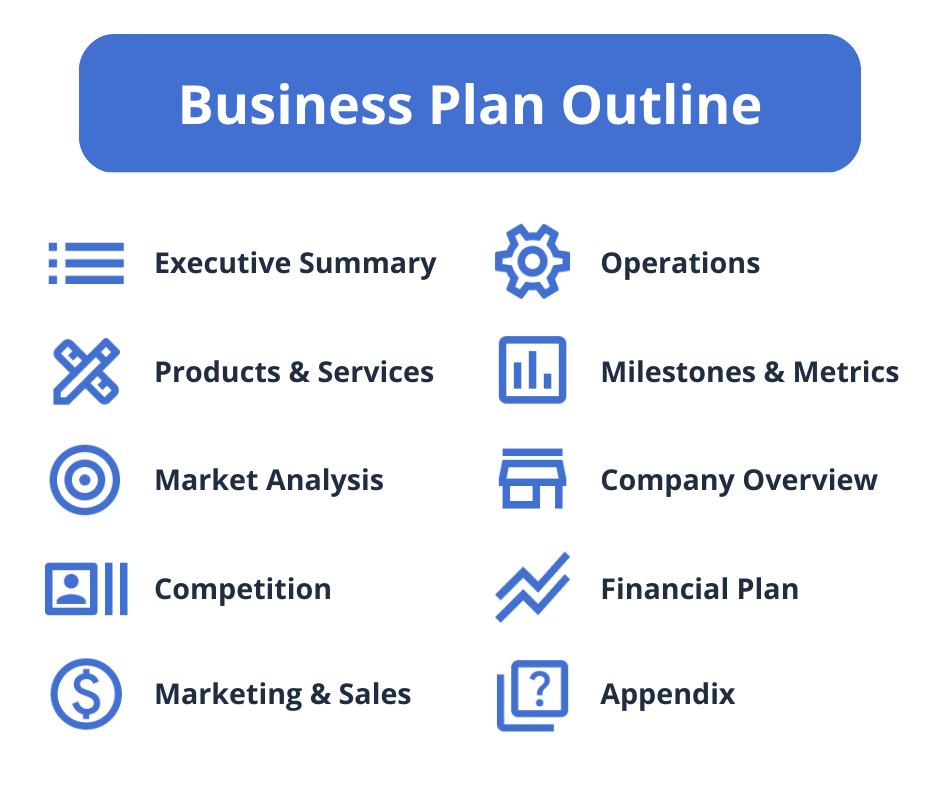

A business plan outline is similar to most business plan templates. It lists the common sections that all business plans should include.

A traditional business plan typically includes an executive summary, an overview of your products and services, thorough market research, a competitive analysis, a marketing and sales strategy, operational and company details, financial projections, and an appendix.

Why is a business plan outline important?

Starting with a business plan outline helps ensure that you’re including all of the necessary information for a complete business plan.

But, depending on what you intend to do with your plan, you may not need all of this information right away. If you’re going to speak with investors or pursue funding, then yes, you’ll need to include everything from this outline.

But, if you’re using your plan to test an idea or help run your business, you may want to opt for a one-page plan. This is a simpler and faster method that is designed to be updated and used day-to-day.

If you’re unsure of which plan is right for you, check out our guide explaining the differences and use cases for each plan type.

10 key sections in a standard business plan outline

No matter the type of business plan you create, these are the ten basic sections you should include. Be sure to download your free business plan template to start drafting your own plan as you work through this outline.

1. Executive summary

While it may appear first, it’s best to write your executive summary last. It’s a brief section that highlights the high-level points you’ve made elsewhere in your business plan.

Summarize the problem you are solving for customers, your solution, the target market, your team that’s building the business, and financial forecast highlights. Keep things as brief as possible and entice your audience to learn more about your company.

Keep in mind, this is the first impression your plan and business will make. After looking over your executive summary, your reader is either going to throw your business plan away or keep reading. So make sure you spend the time to get it just right.

Brought to you by

Create a professional business plan

Using AI and step-by-step instructions

Create Your PlanSecure funding

Validate ideas

Build a strategy

2. Products and services

Start the products and services section of your business plan by describing the problem you are solving for your customer. Next, describe how you solve that problem with your product or service.

If you’ve already made some headway selling your solution, detail that progress here—this is called “traction”. You can also describe any intellectual property or patents that you have if that’s an important part of your business.

3. Market analysis

You need to know your target market—the types of customers you are looking for—and how it’s changing.

Use the market analysis section of your business plan to discuss the size of your market—how many potential customers exist for your business—and if your potential customers can be segmented into different groups, such as age groups or some other demographic.

4. Competition

Describe your competition in this section. If you don’t have any direct competitors, describe what your customers currently do to solve the problem that your product fixes.

If you have direct competition, detail what your strengths and weaknesses are in comparison, and how you’ll differentiate from what is already available.

5. Marketing and sales

Use this business plan section to outline your marketing and sales plan—how you’ll reach your target customers and what the process will be for selling to them.

You’ll want to cover your market position, marketing activities, sales channels, and your pricing strategy. This will likely evolve over time, but it’s best to include anything that clearly details how you will sell and promote your products and services.

6. Operations

What’s included in the operations section really depends on the type of business you are planning for. If your business has a physical location or other facilities, you’ll want to describe them here. If your business relies heavily on technology or specific equipment or tools, you should describe that technology or equipment here.

You can also use this section to describe your supply chain if that’s an important aspect of your business.

7. Milestones and metrics

In a business, milestones are important goals that you are setting for your business. They may be important launch dates, or a timeline of when you’ll get regulatory approval—if that’s something you need for your business. Use this section of your plan to describe those milestones and the roadmap you are planning to follow.

You can also describe important metrics for your business, such as the number of sales leads you expect to get each month or the percentage of leads that will become customers.

8. Company overview and team

The company and team section of your plan is an overview of who you are.

It should describe the organization of your business, and the key members of the management team. It should also provide any historical background about your business. For example, you’ll describe when your company was founded, who the owners are, what state your company is registered in and where you do business, and when/if your company was incorporated.

Be sure to include summaries of your key team members’ backgrounds and experience—these should act like brief resumes—and describe their functions with the company. You should also include any professional gaps you intend to fill with new employees.

9. Financial plan and forecasts

Your financial plan should include a sales forecast, profit and loss, cash flow projections, and balance sheet, along with a brief description of the assumptions you’re making with your projections.

If you are raising money or taking out loans, you should highlight the money you need to launch the business. This part should also include a use of funds report—basically an overview of how the funding will be used in business operations.

And while it’s not required, it may be wise to briefly mention your exit strategy. This doesn’t need to be overly detailed, just a general idea of how you may eventually want to exit your business.

10. Appendix

The end of your business plan should include any additional information to back up specific elements of your plan. More detailed financial statements, resumes for your management team, patent documentation, credit histories, marketing examples, etc.

Detailed business plan outline

If you’re looking for greater insight into what goes into specific planning sections, check out the following outline for a business plan. It can help you develop a detailed business plan or provide guidance as to what may be missing from your current plan.

Keep in mind that every business plan will look a bit different because every business is unique. After all, business planning is to help you be more successful, so focus on the sections that are most beneficial to your business and skip the sections that aren’t useful or don’t apply.

To help, we’ve marked sections that are truly optional with an *.

Executive summary

Company Purpose / Mission Statement

A very brief description of what your business does and/or what its mission is.

Problem We Solve

A summary of the problem you are solving and an identifiable need in the market you are filling.

Our Solution

A description of the product or service you will provide to solve the problem.

Target Market

A defined customer base who will most likely purchase the product or service.

Team

Briefly describe who is behind the business.

Financial Summary

A short overview of revenue goals and profitability timeline.

Traction*

If you’ve already started selling your product or service, highlight important initial details here.

Funding Needed*

If you are raising money for your business, describe how much capital you need.

Products & Services

Problem worth solving

A thorough description of the problem or pain points you intend to solve for your customer base.

Our Solution

A thorough description of your proposed product or service that alleviates the problem for your customer base.

Traction*

Describe any initial evidence that your customers are excited to spend money on your solution. Initial sales or signed contracts are good signs.

Intellectual Property/Patents*

If this is important for your business, outline it here.

Regulatory Requirements*

If government approval is required for your business, explain the details and timeline.

Future Products and Services*

What products and services might you offer in the future once your initial products and services are successful?

Target Market

Market Size & Segments

How many potential customers do you have and what potential groups of customers are separated by specific characteristics?

Market Trends*

How consumers in your target market tend to act including purchasing habits, financial trends, and any other relevant factors.

Market Growth*

The perceived potential increase or decrease in the size of your target market.

Industry Analysis*

If your industry is changing or adjusting over time, describe those changes.

Key Customers*

If your business relies on certain important customers, describe who they are here.

Future Markets*

A snapshot of the potential market based on the last few sections and how your business strategy works within it.

Competition

Current Alternatives

A list of potential competitors. Identifying the competition isn’t always obvious and it may take some digging on your part.

Our Advantages

The strategic advantage(s) that makes your target market more likely to choose you over the competition.

Barriers to Entry*

If there’s anything that makes it more difficult for other people to start competing with you, describe those barriers.

Marketing & Sales

Market positioning

Where do your products or services fit into the market? Are you the low-price leader or the premium option?

Unique value proposition*

What’s special about your offering that makes your customers want to choose it over the competition.

Marketing Plan

An outline of your marketing and advertising strategy including costs, advertising channels, and goals.

Sales Plan

How do you sell your product or service? Self-serve or with a team of sales representatives?

Pricing Strategy*

Describe your pricing and how it compares to alternatives in the market.

Distribution*

Describe how your product gets in front of customers. Are you selling in stores and online? Which retailers?

SWOT Analysis*

Strengths, weaknesses, opportunities, and threats.

Operations

Location & Facilities

If you have a physical presence, describe where and what it is.

Technology

What technology is crucial for your business success?

Equipment & Tools

If special equipment or tools are needed for your business, describe them here.

Sourcing and fulfillment*

If you purchase your products or parts for your products from somewhere else, describe that sourcing and supply chain.

Partners and Resources*

If you have key partners that you work with to make your business a success, describe who they are and what services or products they provide.

Milestones and metrics

Milestones

A detailed roadmap of specific goals and objectives you plan to achieve will help you manage and steer your business.

Key metrics

Performance measurements that help you gauge the overall performance and health of your business.

Company overview and team

Organizational structure

An overview of the legal structure of your business.

Company history and ownership

A summary of your company’s history and how it relates to planning your business.

Management team

The team that is starting or running your business and why they are uniquely qualified to make the business a success.

Management team gaps

Key positions that your business will need to fill to make it successful.

Financial plan and forecast

Projected profit and loss

How much money you will bring in by selling products and/or services and how much profit you will make or lose after accounting for costs and expenses.

Projected cash flow

How and when cash moves in and out of your business. This also includes your overall cash position.

Projected balance sheet

Expected balances for business assets, liabilities, and equity.

Use of funds

If you are raising money either through loans or investment, explain how funds will be used. This is typically meant to be shared with investors or lenders.

Exit strategy

A brief explanation of how you intend to eventually exit from your business. This could include selling the business, going public, transitioning the business to a family member/employee, etc.

Appendix

A repository for any additional information, including charts and graphs, to support your business plan.

Business plan outline FAQ

There’s no real established order to business plans, aside from keeping the Executive Summary at the top. As long as you have all of the main business plan components, then the order should reflect your goals.

If this is meant solely for your personal use, lay it out as a roadmap with similar sections grouped together for easy reference. If you’re pitching this to potential investors, lead with the stronger sections to emphasize the pitch. Then if you’re unsure of what order makes sense, then just stick to the outline in this article.

Every business plan should include bar charts and pie charts to illustrate the numbers. It’s a simple way for you, your team, and investors to visualize and digest complex financial information.

Cash flow is the single most important numerical analysis in a business plan, and a standard cash flow statement or table should never be missing. Most standard business plans also include a sales forecast and income statement (also called profit and loss), and a balance sheet.

There’s no perfect length for a business plan. A traditional business plan can be anywhere from 10 to 50 pages long depending on how much detail you include in each section. However, as we said before unless you intend to pursue funding, you likely don’t need a lengthy business plan at first.