Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

How to Create an Expense Budget

4 min. read

Updated October 27, 2023

One of the fundamentals of your financial plan and the start of good business management is managing expenses. That starts with an expense budget. Set your budget as a goal, then review and revise often to stay on track. Being right on budget is usually good, but good management takes the regular review to check on the timing, efficiency, and results of what your business spends.

For the record, we could call it an expense forecast, or projected expenses. Those are the same thing. Regardless of what you call it when you combine it with projected sales and costs, you have what you need to project your profit or loss.

The key types of expenses in business spending

Expenses make up just one of the three common types of spending in a normal business.

Expenses mostly include operating expenses, like rent, utilities, advertising, and payroll. That’s what I’m talking about in this article.

Direct costs are another type of spending—another way to say it is the costs of goods sold (COGS), or what you spend on what you sell. For example, the COGS for a bookstore are the costs of buying the books it resells to its customers. Those go in your sales forecast.

Repaying debts and purchasing assets is the third type of spending. These affect your cash flow (the amount of real cash you have on hand to pay bills) and your balance sheet, but not your profits—which are left over after you pay your bills.

Your expense budget

It’s all about educated guessing.

Don’t expect to accurately guess the future. Do use your experience, educated guessing, a bit of research, and common sense to estimate expenses in line with sales and costs and your planned activities.

The math is simple

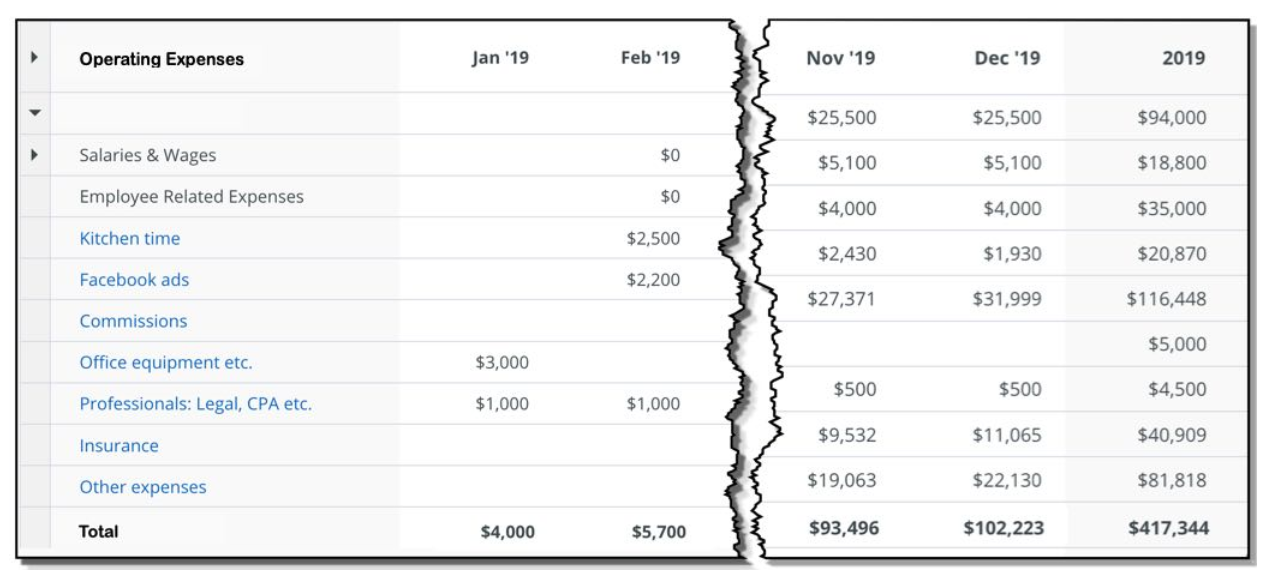

The illustration here shows a sample expense budget from a soup delivery subscription plan we use as an example.

The math and the logic is simple. Make the rows match your accounting as much as possible. Set timeframes and estimate what expenses will be for each of the next 12 months, and then for the following two years as estimated annual totals.

In the example, the two owners know their business. As they develop their budget, they have a good idea of what they pay for kitchen time, Facebook ads, commissions, office equipment, and so on.

And if you don’t know these numbers for your business, find out. If you don’t know rents, talk to a broker, see some locations, and estimate what you’ll end up paying.

Do the same for utilities, insurance, and leased equipment: Make a good list, call people, and take a good educated guess.

Brought to you by

Create a professional business plan

Using AI and step-by-step instructions

Create Your PlanSecure funding

Validate ideas

Build a strategy

Payroll and payroll taxes are operating expenses

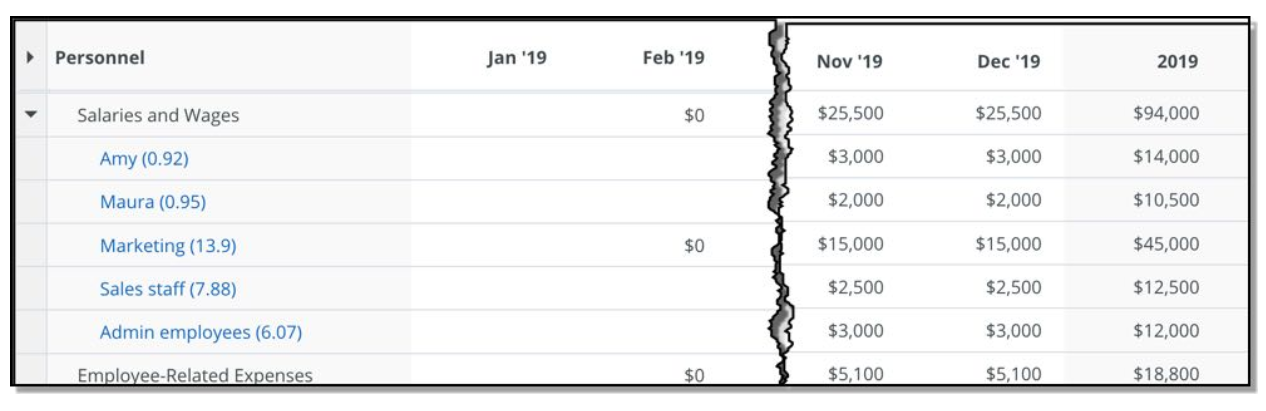

Expenses also include payroll, wages and salaries, or compensation. They are worth a list of their own. In the case of the soup business in the example above, for payroll, they do a separate list so they can keep track. Payroll is a serious fixed cost and an obligation. Here is the payroll budget associated with the sample plan above.

Notice that the totals from the personnel plan show up in the expense budget. And you can see the estimated expense for benefits over and above the gross salary. Employee-related expenses include payroll taxes along with what they budget for health insurance and other benefits.

Don’t worry too much about depreciation

Depreciation is a special case. Traditionally, it counts as an operating expense, but a lot of businesses budget for it separately because it doesn’t actually cost money.

It’s a concept the tax code allows us to deduct as a business expense, in theory, to allow for the gradual decline in the value of an asset, or—depending on which expert you follow—to allow money to buy new assets when existing assets become obsolete.

The argument for including it in the expenses is that it gives a more accurate picture of profits. And many people separate depreciation from the other expenses so they can calculate EBITDA, which is earnings before interest, taxes, depreciation, and amortization (which is like depreciation, but for intangible assets).

Bottom line: Include it or not; it’s your choice.

Yes, interest expense is an expense

Because interest is also excluded from EBITDA, many people also exclude it from operating expenses. They list it separately, along with depreciation, to make the EBITDA calculation easier. I say you can do that either way, it doesn’t matter, as long as you include the interest expense in your budget. Because, unlike depreciation, interest does cost money.

Remember the underlying goal

The purpose of the budget is to help you make good decisions.

Set expenses to align with your strategy and tactics, so you do what works best for your long-term progress. Match your accounting categories as much as possible, so you can track later. Keep track of assumptions so when things come out different from the plan—and they always do—you can adjust quickly.

.png?format=auto)