Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

How to Create a Sales Forecast

11 min. read

Updated October 27, 2023

Business owners are often afraid to forecast sales. But, you shouldn’t be. Because you can successfully forecast your own business’s sales.

You don’t have to be an MBA or CPA. It’s not about some magic right answer that you don’t know. It’s not about training you don’t have. It doesn’t take spreadsheet modeling (much less econometric modeling) to estimate units and price per unit for future sales. You just have to know your own business.

Forecasting isn’t about seeing into the future

Sales forecasting is much easier than you think and much more useful than you imagine.

I was a vice president of a market research firm for several years, doing expensive forecasts, and I saw many times that there’s nothing better than the educated guess of somebody who knows the business well. All those sophisticated techniques depend on data from the past — and the past, by itself, isn’t the best predictor of the future. You are.

It’s not about guessing the future correctly. We’re human; we don’t do that well. Instead, it’s about setting down assumptions, expectations, drivers, tracking, and management. It’s about doing your job, not having precognitive powers.

Successful forecasting is driven by regular reviews

What really matters is that you review and revise your forecast regularly. Spending should be tied to sales, so the forecast helps you budget and manage. You measure the value of a sales forecast like you do anything in business, by its measurable business results.

That also means you should not back off from forecasting because you have a new product, or new business, without past data. Lay out the sales drivers and interdependencies, to connect the dots, so that as you review plan-versus-actual results every month, you can easily make course corrections.

If you think sales forecasting is hard, try running a business without a forecast. That’s much harder.

Your sales forecast is also the backbone of your business plan. People measure a business and its growth by sales, and your sales forecast sets the standard for expenses, profits, and growth. The sales forecast is almost always going to be the first set of numbers you’ll track for plan versus actual use, even if you do no other numbers.

If nothing else, just forecast your sales, track plan-versus-actual results, and make corrections — that process alone, just the sales forecast and tracking is in itself already business planning. To get started on building your forecast follow these steps.

And if you run a subscription-based business, we have a guide dedicated to building a sales forecast for that business model.

Step 1: Set up your lines of sales

Most forecasts show several distinct lines of sales. Ideally, your sales lines match your accounting, but not necessarily in the same level of detail.

For example, a restaurant ought not to forecast sales for each item on the menu. Instead, it forecasts breakfasts, lunches, dinners, and drinks, summarized. And a bookstore ought not to forecast sales by book, and not even by topic or author, but rather by lines of sales such as hardcover, softcover, magazines, and maybe categories (such as fiction, non-fiction, travel, etc.) if that works.

Always try to set your streams to match your accounting, so you can look at the difference between the forecast and actual sales later. This is excellent for real business planning. It makes the heart of the process, the regular review, and revision, much easier. The point is better management.

For instance, in a bicycle retail store business plan, the owner works with five lines of sales, as shown in the illustration here.

In this sample case, the revenue includes new bikes, repair, clothing, accessories, and a service contract. The bookkeeping for this retail store tracks sales in those same five categories.

Brought to you by

Create a professional business plan

Using AI and step-by-step instructions

Create Your PlanSecure funding

Validate ideas

Build a strategy

Step 2: Forecast line by line

There are many ways to forecast a line of sales.

The method for each row depends on the business model

Among the main methods are:

- Unit sales: My personal favorite. Sales = units times price. You set an average price and forecast the units. And of course, you can change projected pricing over time. This is my favorite for most businesses because it gives you two factors to act on with course corrections: unit sales, or price.

- Service units: Even though services don’t sell physical units, most sell billable units, such as billable hours for lawyers and accountants, or trips for transportations services, engagements for consultants, and so forth.

- Recurring charges: Subscriptions. For each month or year, it has to forecast new signups, existing monthly charges, and cancellations. Estimates depend on both new signups and cancellations, which is often called “churn.”

- Revenue only: For those who prefer to forecast revenue by the stream as just the money, without the extra information of breaking it into units and prices.

Most sales forecast rows are simple math

For a business plan, I recommend you make your sales forecast a detailed look at the next 12 months and then broadly cover two years after that. Here’s how to approach each method of line-by-line forecasting.

Start with units if you can

For unit sales, start by forecasting units month by month, as shown here below for the new bike’s line of sales in the bicycle shop plan:

I recommend looking at the visual as you forecast the units because most of us can see trends easier when we look at the line, as shown in the illustration, rather than just the numbers. You can also see the numbers in the forecast near the bottom. The first year, fiscal 2021 in this forecast, is the sum of those months.

Estimate price assumptions

With a simple revenue-only assumption, you do one row of units as shown in the above illustration, and you are done. The units are dollars, or whatever other currency you are using in your forecast. In this example, the new bicycle product will be sold for an average of $550.00.

That’s a simplifying assumption, taking the average price, not the detailed price for each brand or line. Garrett, the shop owner, uses his past results to determine his actual average price for the most recent year. Then he rounds that estimate and adds his own judgment and educated guess on how that will change.

Multiply price times units

Multiplying units times the revenue per unit generates the sales forecast for this row. So for example the $18,150 shown for October of 2020 is the product of 33 units times $550 each. And the $21,450 shown for the next month is the product of 39 units times $550 each.

Subscription models are more complicated

Lately, a lot of businesses offer their buyers subscriptions, such as monthly packages, traditional or online newspapers, software, and even streaming services. All of these give a business recurring revenues, which is a big advantage.

For subscriptions, you normally estimate new subscriptions per month and canceled subscriptions per month, and leave a calculation for the actual subscriptions charged. That’s a more complicated method, which demands more details.

For that, you can refer to detailed discussions on subscription forecasting in How to Forecast Sales for a Subscription Business.

But how do you know what numbers to put into your sales forecast?

The math may be simple, yes, but this is predicting the future, and humans don’t do that well. So, don’t try to guess the future accurately for months in advance.

Instead, aim for making clear assumptions and understanding what drives your sales, such as web traffic and conversions, in one example, or the direct sales pipeline and leads, in another. Review results every month, and revise your forecast. Your educated guesses become more accurate over time.

Experience in the field is a huge advantage

In a normal ongoing business, the business owner has ample experience with past sales. They may not know accounting or technical forecasting, but they know their business. They are aware of changes in the market, their own business’s promotions, and other factors that business owners should know. They are comfortable making educated guesses.

If you don’t personally have the experience, try to find information and make guesses based on the experience of an employee, your mentor, or others you’ve spoken within your field.

Use past results as a guide

Use results from the recent past if your business has them. Start a forecast by putting last year’s numbers into next year’s forecast, and then focus on what might be different this year from next.

Do you have new opportunities that will make sales grow? New marketing activities, promotions? Then increase the forecast. New competition, and new problems? Nobody wants to forecast decreasing sales, but if that’s likely, you need to deal with it by cutting costs or changing your focus.

Look for drivers

To forecast sales for a new restaurant, first, draw a map of tables and chairs and then estimate how many meals per mealtime at capacity, and in the beginning. It’s not a random number; it’s a matter of how many people come in.

To forecast sales for a new mobile app, you might get data from the Apple and Android mobile app stores about average downloads for different apps. A good web search might also reveal some anecdotal evidence, blog posts, and news stories, about the ramp-up of existing apps that were successful.

Get those numbers and think about how your case might be different. Maybe you drive downloads with a website, so you can predict traffic from past experience and then assume a percentage of web visitors who will download the app.

Estimate direct costs

Direct costs are also called the cost of goods sold (COGS) and per-unit costs. Direct costs are important because they help calculate gross margin, which is used as a basis for comparison in financial benchmarks, and are an instant measure (sales less direct costs) of your underlying profitability.

For example, I know from benchmarks that an average sporting goods store makes a 34 percent gross margin. That means that they spend $66 on average to buy the goods they sell for $100.

Not all businesses have direct costs. Service businesses supposedly don’t have direct costs, so they have a gross margin of 100 percent. That may be true for some professionals like accountants and lawyers, but a lot of services do have direct costs. For example, taxis have gasoline and maintenance. So do airlines.

A normal sales forecast includes units, price per unit, sales, direct cost per unit, and direct costs. The math is simple, with the direct costs per unit related to total direct costs the same way price per unit relates to total sales.

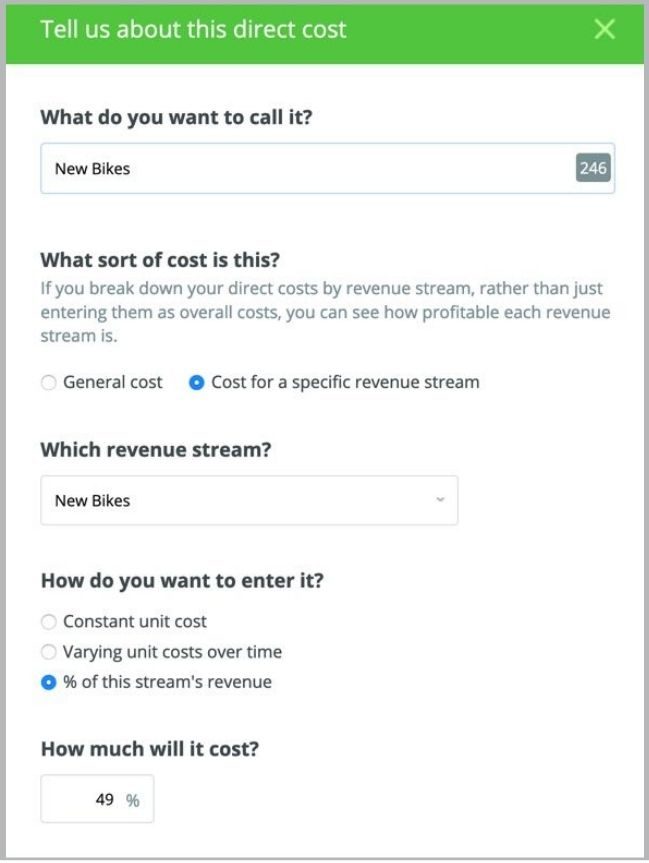

Multiply the units projected for any time period by the unit direct costs, and that gives you total direct costs. And here too, assume this view is just a cut-out, it flows to the right. In this example, Garrett the shop owner projected the direct costs of new bikes based on the assumption of 49 percent of sales.

Given the unit forecast estimate, the calculation of units times direct costs produces the forecast shown in the illustration below for direct costs for that product. So therefore the projected direct costs for new bikes in October is $8,894, which is 49% of the projected sales for that month, $18,150.

Never forecast in a vacuum

Never think of your sales forecast in a vacuum. It flows from the strategic action plans with their assumptions, milestones, and metrics. Your marketing milestones affect your sales. Your business offering milestones affect your sales.

When you change milestones—and you will, because all business plans change—you should change your sales forecast to match.

Timing matters

Your sales are supposed to refer to when the ownership changes hands (for products) or when the service is performed (for services). It isn’t a sale when it’s ordered, or promised, or even when it’s contracted.

With proper accrual accounting, it is a sale even if it hasn’t been paid for. With so-called cash-based accounting, by the way, it isn’t a sale until it’s paid for. Accrual is better because it gives you a more accurate picture, unless you’re very small and do all your business, both buying and selling, with cash only.

I know that seems simple, but it’s surprising how many people decide to do something different. The penalty for doing things differently is that then you don’t match the standard, and the bankers, analysts, and investors can’t tell what you meant.

This goes for direct costs, too. The direct costs in your monthly profit and loss statement are supposed to be just the costs associated with that month’s sales. Please notice how, in the examples above, the direct costs for the sample bicycle store are linked to the actual unit sales.

Live with your assumptions

Sales forecasting is not about accurately guessing the future. It’s about laying out your assumptions so you can manage changes effectively as sales and direct costs come out different from what you expected. Use this to adjust your sales forecast and improve your business by making course corrections to deal with what is working and what isn’t.

I believe that even if you do nothing else, by the time you use a sales forecast and review plan versus actual results every month, you are already managing with a business plan. You can’t review actual results without looking at what happened, why, and what to do next.

.png?format=auto)