Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

How to Write a Competitive Analysis for Your Business Plan

11 min. read

Updated January 3, 2024

Do you know who your competitors are? If you do, have you taken the time to conduct a thorough competitor analysis?

Knowing your competitors, how they operate, and the necessary benchmarks you need to hit are crucial to positioning your business for success. Investors will also want to see an analysis of the competition in your business plan.

In this guide, we’ll explore the significance of competitive analysis and guide you through the essential steps to conduct and write your own.

You’ll learn how to identify and evaluate competitors to better understand the opportunities and threats to your business. And you’ll be given a four-step process to describe and visualize how your business fits within the competitive landscape.

What is a competitive analysis?

A competitive analysis is the process of gathering information about your competitors and using it to identify their strengths and weaknesses. This information can then be used to develop strategies to improve your own business and gain a competitive advantage.

How to conduct a competitive analysis

Before you start writing about the competition, you need to conduct your analysis. Here are the steps you need to take:

1. Identify your competitors

The first step in conducting a comprehensive competitive analysis is to identify your competitors.

Start by creating a list of both direct and indirect competitors within your industry or market segment. Direct competitors offer similar products or services, while indirect competitors solve the same problems your company does, but with different products or services.

Keep in mind that this list may change over time. It’s crucial to revisit it regularly to keep track of any new entrants or changes to your current competitors. For instance, a new competitor may enter the market, or an existing competitor may change their product offerings.

2. Analyze the market

Once you’ve identified your competitors, you need to study the overall market.

This includes the market size, growth rate, trends, and customer preferences. Be sure that you understand the key drivers of demand, demographic and psychographic profiles of your target audience, and any potential market gaps or opportunities.

Conducting a market analysis can require a significant amount of research and data collection. Luckily, if you’re writing a business plan you’ll follow this process to complete the market analysis section. So, doing this research has value for multiple parts of your plan.

Brought to you by

Create a professional business plan

Using AI and step-by-step instructions

Create Your PlanSecure funding

Validate ideas

Build a strategy

3. Create a competitive framework

You’ll need to establish criteria for comparing your business with competitors. You want the metrics and information you choose to provide answers to specific questions. (“Do we have the same customers?” “What features are offered?” “How many customers are being served?”)

Here are some common factors to consider including:

- Market share

- Product/service offerings or features

- Pricing

- Distribution channels

- Target markets

- Marketing strategies

- Customer service

4. Research your competitors

You can now begin gathering information about your competitors. Because you spent the time to explore the market and set up a comparison framework—your research will be far more focused and easier to complete.

There’s no perfect research process, so start by exploring sources such as competitor websites, social media, customer reviews, industry reports, press releases, and public financial statements. You may also want to conduct primary research by interviewing customers, suppliers, or industry experts.

You can check out our full guide on conducting market research for more specific steps.

5. Assess their strengths and weaknesses

Evaluate each competitor based on the criteria you’ve established in the competitive framework. Identify their key strengths (competitive advantages) and weaknesses (areas where they underperform).

6. Identify opportunities and threats

Based on the strengths and weaknesses of your competitors, identify opportunities (areas where you can outperform them) and threats (areas where they may outperform you) for your business.

You can check out our full guide to conducting a SWOT analysis for more specific questions that you should ask as part of each step.

How to write your competitive analysis

Once you’ve done your research, it’s time to present your findings in your business plan. Here are the steps you need to take:

1. Determine who your audience is

Who you are writing a business plan for (investors, partners, employees, etc.) may require you to format your competitive analysis differently.

For an internal business plan you’ll use with your team, the competition section should help them better understand the competition. You and your team will use it to look at comparative strengths and weaknesses to help you develop strategies to gain a competitive advantage.

For fundraising, your plan will be shared with potential investors or as part of a bank loan. In this case, you’re describing the competition to reassure your target reader. You are showing awareness and a firm understanding of the competition, and are positioned to take advantage of opportunities while avoiding the pitfalls.

2. Describe your competitive position

You need to know how your business stacks up, based on the values it offers to your chosen target market. To run this comparison, you’ll be using the same criteria from the competitive framework you completed earlier. You need to identify your competitive advantages and weaknesses, and any areas where you can improve.

The goal is positioning (setting your business up against the background of other offerings), and making that position clear to the target market. Here are a few questions to ask yourself in order to define your competitive position:

- How are you going to take advantage of your distinctive differences, in your customers’ eyes?

- What are you doing better?

- How do you work toward strengths and away from weaknesses?

- What do you want the world to think and say about you and how you compare to others?

3. Visualize your competitive position

There are a few different ways to present your competitive framework in your business plan. The first is a “positioning map” and the second is a “competitive matrix”. Depending on your needs, you can use one or both of these to communicate the information that you gathered during your competitive analysis:

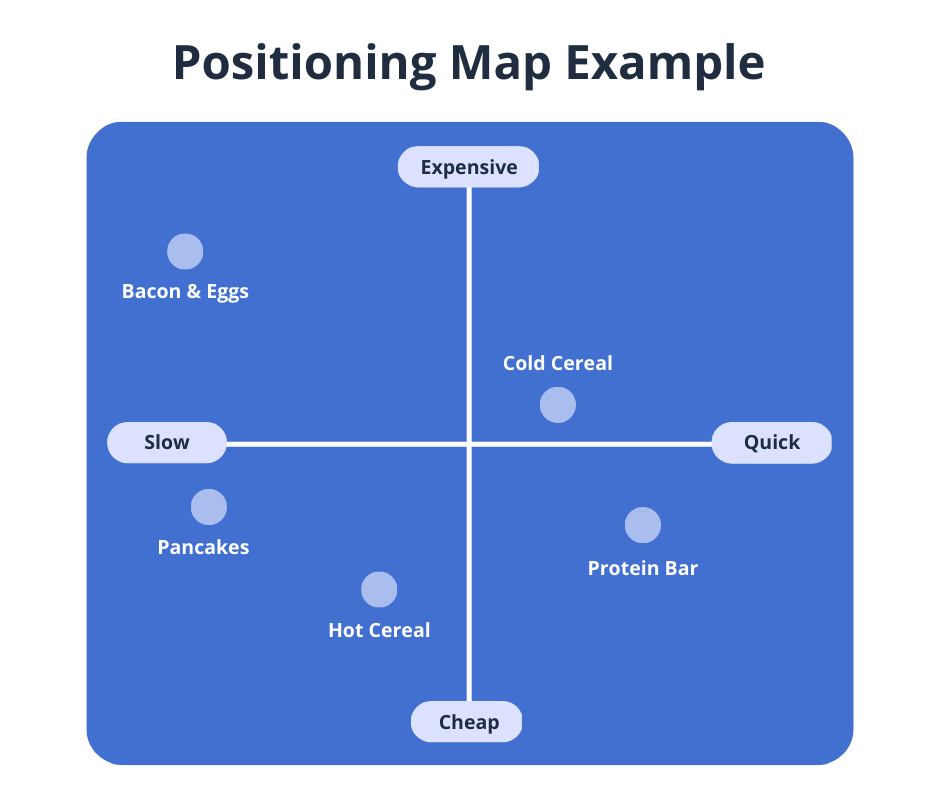

Positioning map

The positioning map plots two product or business benefits across a horizontal and vertical axis. The furthest points of each represent opposite extremes (Hot and cold for example) that intersect in the middle. With this simple chart, you can drop your own business and the competition into the zone that best represents the combination of both factors.

I often refer to marketing expert Philip Kohler’s simple strategic positioning map of breakfast, shown here. You can easily draw your own map with any two factors of competition to see how a market stacks up.

It’s quite common to see the price on one axis and some important qualitative factor on the other, with the assumption that there should be a rough relationship between price and quality.

Competitive matrix

It’s pretty common for most business plans to also include a competitive matrix. It shows how different competitors stack up according to the factors identified in your competitive framework.

How do you stack up against the others? Here’s what a typical competitive matrix looks like:

For the record, I’ve seen dozens of competitive matrices in plans and pitches. I’ve never seen a single one that didn’t show that this company does more of what the market wants than all others. So maybe that tells you something about credibility and how to increase it. Still, the ones I see are all in the context of seeking investment, so maybe that’s the nature of the game.

4. Explain your strategies for gaining a competitive edge

Your business plan should also explain the strategies your business will use to capitalize on the opportunities you’ve identified while mitigating any threats from competition. This may involve improving your product/service offerings, targeting underserved market segments, offering more attractive price points, focusing on better customer service, or developing innovative marketing strategies.

While you should cover these strategies in the competition section, this information should be expanded on further in other areas of your business plan.

For example, based on your competitive analysis you show that most competitors have the same feature set. As part of your strategy, you see a few obvious ways to better serve your target market with additional product features. This information should be referenced within your products and services section to back up your problem and solution statement.

Why competition is a good thing

Business owners often wish that they had no competition. They think that with no competition, the entire market for their product or service will be theirs. That is simply not the case—especially for new startups that have truly innovative products and services. Here’s why:

Competition validates your idea

You know you have a good idea when other people are coming up with similar products or services. Competition validates the market and the fact that there are most likely customers for your new product. This also means that the costs of marketing and educating your market go down (see my next point).

Competition helps educate your target market

Being first-to-market can be a huge advantage. It also means that you will have to spend way more than the next player to educate customers about your new widget, your new solution to a problem, and your new approach to services.

This is especially true for businesses that are extremely innovative. These first-to-market businesses will be facing customers that didn’t know that there was a solution to their problem. These potential customers might not even know that they have a problem that can be solved in a better way.

If you’re a first-to-market company, you will have an uphill battle to educate consumers—an often expensive and time-consuming process. The 2nd-to-market will enjoy all the benefits of an educated marketplace without the large marketing expense.

Competition pushes you

Businesses that have little or no competition become stagnant. Customers have few alternatives to choose from, so there is no incentive to innovate. Constant competition ensures that your marketplace continues to evolve and that your product offering continues to evolve with it.

Competition forces focus & differentiation

Without competition, it’s easy to lose focus on your core business and your core customers and start expanding into areas that don’t serve your best customers. Competition forces you and your business to figure out how to be different than your competition while focusing on your customers. In the long term, competition will help you build a better business.

What if there is no competition?

One mistake many new businesses make is thinking that just because nobody else is doing exactly what they’re doing, their business is a sure thing. If you’re struggling to find competitors, ask yourself these questions.

Is there a good reason why no one else is doing it?

The smart thing to do is ask yourself, “Why isn’t anyone else doing it?”

It’s possible that nobody’s selling cod-liver frozen yogurt in your area because there’s simply no market for it. Ask around, talk to people, and do your market research. If you determine that you’ve got customers out there, you’re in good shape.

But that still doesn’t mean there’s no competition.

How are customers getting their needs met?

There may not be another cod-liver frozen yogurt shop within 500 miles. But maybe an online distributor sells cod-liver oil to do-it-yourselfers who make their own fro-yo at home. Or maybe your potential customers are eating frozen salmon pops right now.

Are there any businesses that are indirect competitors?

Don’t think of competition as only other businesses that do exactly what you do. Think about what currently exists on the market that your product would displace.

It’s the difference between direct competition and indirect competition. When Henry Ford started successfully mass-producing automobiles in the U.S., he didn’t have other automakers to compete with. His competition was horse-and-buggy makers, bicycles, and railroads.

Do a competitive analysis, but don’t let it derail your planning

While it’s important that you know the competition, don’t get too caught up in the research.

If all you do is track your competition and do endless competitive analyses, you won’t be able to come up with original ideas. You will end up looking and acting just like your competition. Instead, make a habit of NOT visiting your competition’s website, NOT going into their store, and NOT calling their sales office.

Focus instead on how you can provide the best service possible and spend your time talking to your customers. Figure out how you can better serve the next person that walks in the door so that they become a lifetime customer, a reference, or a referral source.

If you focus too much on the competition, you will become a copycat. When that happens, it won’t matter to a customer if they walk into your store or the competition’s because you will both be the same.

.png?format=auto)