An entrepreneur. A disruptor. An advocate. Caroline has been the CEO and co-founder of two tech startups—one failed and one she sold. She is passionate about helping other entrepreneurs realize their full potential and learn how to step outside of their comfort zones to catalyze their growth. Caroline is currently executive director of Oregon RAIN. She provides strategic leadership for the organization’s personnel, development, stakeholder relations, and community partnerships. In her dual role as the venture catalyst manager, Cummings oversees the execution of RAIN’s Rural Venture Catalyst programs. She provides outreach and support to small and rural communities; she coaches and mentors regional entrepreneurs, builds strategic local partnerships, and leads educational workshops.

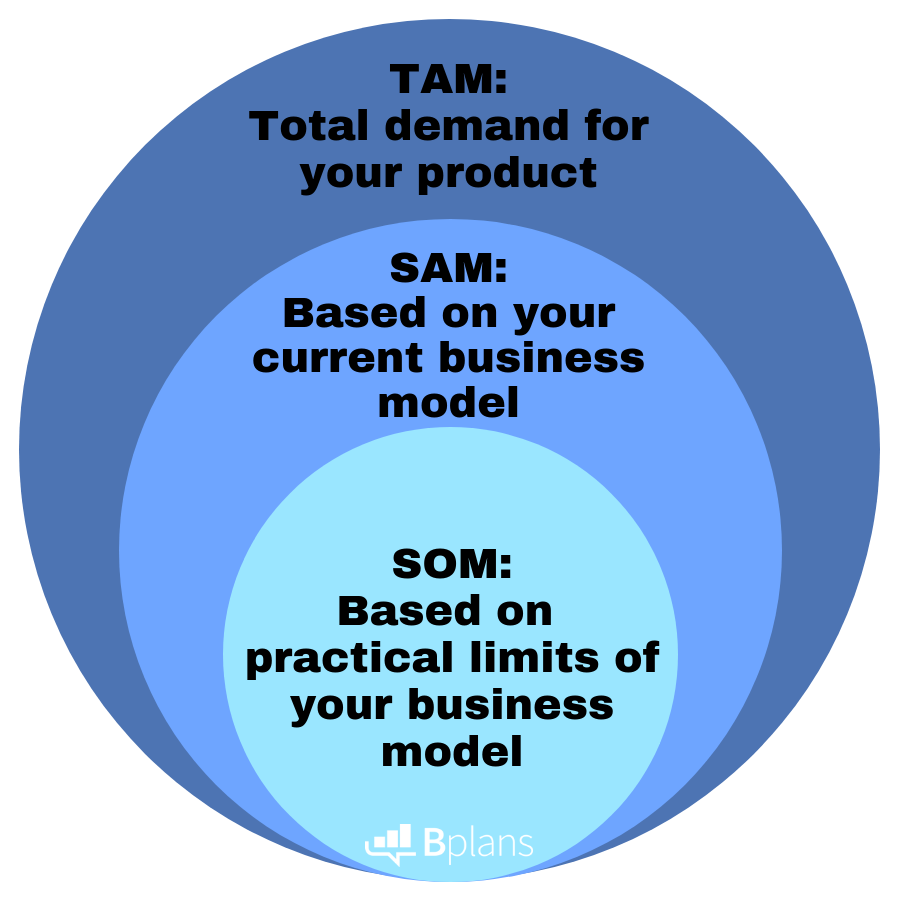

How to Use TAM, SAM, SOM to Determine Market Size

3 min. read

Updated October 27, 2023

Having viewed several business plans over the years, a common (and very important) item missing from most plans is a breakdown of the company’s TAM, SAM, and SOM.

Wondering what these acronyms mean? Well, you’re not alone—many entrepreneurs are not familiar with these terms.

What is TAM?

TAM = Total Addressable/Available Market is the total market for your product. This is everyone in the world who could buy your product, regardless of the competition in the market.

What is SAM?

SAM = Serviceable Available Market is the portion of the market that you can acquire. For example, your product may only be available in one language, so your SAM would be the subset of the TAM that speaks the language that your product is developed for.

What is SOM?

SOM = Service Obtainable Market is the subset of your SAM that you will realistically get to use your product. This is effectively your target market that you will initially try to sell to.

How do you identify TAM, SAM, and SOM?

Identifying your TAM, SAM, and SOM requires some market research (levels of research vary depending on your product and market potential), but once you gather the research through your market analysis, you’ll have a better idea of the percentages that coincide with each area.

Why is identifying your SOM important?

Identifying your SOM, or your target market, is an important step because building a marketing plan around your TAM—in other words, everyone—is a huge waste of resources. Figuring out who exactly you think will actually buy your product will help focus your reach.

What’s an example of TAM, SAM, SOM?

You’re starting a concierge service in your city that focuses on doing tasks/running errands for busy people.

Your TAM (total available market) would be all people who may have a need for help doing tasks and running errands in your town. If your town has 150,000 people, you may find (through market research) that the total possible demand for your business in your city is 33 percent (or 50,000 people). You might arrive at this number by excluding people who are under 18 years old and other groups of people who can’t purchase your services.

Your SAM (serviceable available market) would be the portion of that 50,000 whom your current business model is targeting (this will be outlined in your business plan). For example, your business model focused on serving people who are ages 35 to 55, with small children and disposable income. You may then discover that there are 20,000 of these people, which means your SAM is 40 percent of your TAM.

Your SOM (serviceable obtainable market) would be the portion of your SAM that your business model can currently realistically serve. For example, you may only have three employees (yourself and two others) and can only serve people who live within a 2-mile radius of downtown, so realistically what percentage of your SAM (20,000 people) can you reach in the first 2 to 3 years?

Let’s assume your company can effectively provide concierge services to 100 people a month or 1,200 people a year. This means your SOM is about 6 percent of your SAM.

If you’re seeking funding, savvy investors will ask you for these items in your business plan, and they’ll want you to be able to back up your numbers. This is why conducting some market research upfront is important—and even advisable before you begin writing your business plan. It gives you the validation of your market potential.

Hopefully, this clears up a bit of the market reach acronym soup!

.png?format=auto)