Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

How to Create a Cash Flow Forecast

10 min. read

Updated October 27, 2023

A good cash flow forecast might be the most important single piece of a business plan. All the strategy, tactics, and ongoing business activities mean nothing if there isn’t enough money to pay the bills.

That’s what a cash flow forecast is about—predicting your money needs in advance.

By cash, we mean money you can spend. Cash includes your checking account, savings, and liquid securities like money market funds. It is not just coins and bills.

Profits aren’t the same as cash

Profitable companies can run out of cash if they don’t know their numbers and manage their cash as well as their profits.

For example, your business can spend money that does not show up as an expense on your profit and loss statement. Normal expenses reduce your profitability. But, certain spending, such as spending on inventory, debt repayment, new equipment, and purchasing assets reduces your cash but does not reduce your profitability. Because of this, your business can spend money and still look profitable.

On the sales side of things, your business can make a sale to a customer and send out an invoice, but not get paid right away. That sale adds to the revenue in your profit and loss statement but doesn’t show up in your bank account until the customer pays you.

That’s why a cash flow forecast is so important. It helps you predict how much money you’ll have in the bank at the end of every month, regardless of how profitable your business is.

Learn more about the differences between cash and profits.

Two ways to create a cash flow forecast

There are several legitimate ways to do a cash flow forecast. The first method is called the “Direct Method” and the second is called the “Indirect Method.” Both methods are accurate and valid – you can choose the method that works best for you and is easiest for you to understand.

Unfortunately, experts can be annoying. Sometimes it seems like as soon as you use one method, somebody who is supposed to know business financials tells you you’ve done it wrong. Often that means that the expert doesn’t know enough to realize there is more than one way to do it.

The direct method for forecasting cash flow

The direct method for forecasting cash flow is less popular than the indirect method but it can be much easier to use.

The reason it’s less popular is that it can’t be easily created using standard reports from your business’s accounting software. But, if you’re creating a forecast – looking forward into the future – you aren’t relying on reports from your accounting system so it may be a better choice for you.

That downside of choosing the direct method is that some bankers, accountants, and investors may prefer to see the indirect method of a cash flow forecast. Don’t worry, though, the direct method is just as accurate. After we explain the direct method, we’ll explain the indirect method as well.

The direct method of forecasting cash flow relies on this simple overall formula:

Cash Flow = Cash Received – Cash Spent

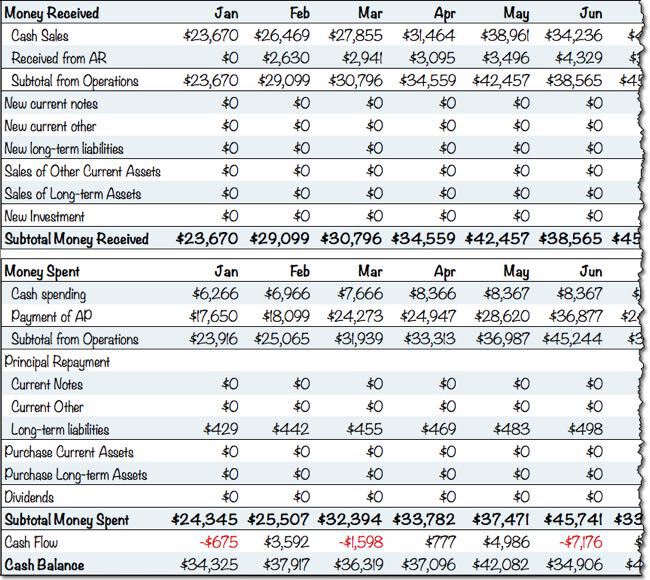

And here’s what that cash flow forecast actually looks like:

Let’s start by estimating your cash received and then we’ll move on to the other sections of the cash flow forecast.

Brought to you by

Create a professional business plan

Using AI and step-by-step instructions

Create Your PlanSecure funding

Validate ideas

Build a strategy

Forecasting cash received

You receive cash from four primary sources:

1. Sales of your products and services

In your cash flow forecast, this is the “Cash from Operations” section. When you sell your products and services, some customers will pay you immediately in cash – that’s the “cash sales” row in your spreadsheet. You get that money right away and can deposit it in your bank account.

You might also send invoices to customers and then have to collect payment. When you do that, you keep track of the money you are owed in Accounts Receivable. When customers pay those invoices, that cash shows up on your cash flow forecast in the “Cash from Accounts Receivable” row. The easiest way to think about forecasting this row is to think about what invoices will be paid by your customers and when.

2. New loans and investments in your business

You can also receive cash by getting a new loan from a bank or an investment. When you receive this kind of cash, you’ll track it in the rows for loans and investments. It’s worth keeping these two different types of cash in-flows separate from each other, mostly because loans need to be repaid while investments do not need to be repaid.

3. Sales of assets

Assets are things that your business owns, such as vehicles, equipment, or property. When you sell an asset, you’ll usually receive cash from that sale and you track that cash in the “Sales of Assets” section of your cash flow forecast. For example, if you sell a truck that your company no longer needs, the proceeds from that sale would show up in your cash flow statement.

4. Other income and sales tax

Businesses can bring in money from other sources besides sales. For example, your business may make interest income from the money that it has in a savings account.

Many businesses also collect taxes from their customers in the form of sales tax, VAT, HST/GST, and other tax mechanisms. Ideally, businesses record the collection of this money not in sales but in the cash flow forecast in a specific row. You want to do this because the tax money collected isn’t yours – it’s the government’s money and you’ll eventually end up paying it to them.

Forecasting cash spent

Similar to how you forecast the cash that you plan on receiving, you’ll forecast the cash that you plan on spending in a few categories:

1. Cash spending and paying your bills

You’ll want to forecast two types of cash spending related to your business’s operations: Cash Spending and Payment of Accounts Payable. Cash spending is money that you spend when you use petty cash or pay a bill immediately.

But, there are also bills that you get and then pay later. You track these bills in Accounts Payable. When you pay bills that you’ve been tracking in accounts payable, that cash payment will show up in your cash flow forecast as “payment of accounts payable”. When you’re forecasting this row, think about what bills you’ll pay and when you’ll pay them.

In this section of your cash flow forecast, you exclude a few things: loan payments, asset purchases, dividends, and sales taxes.

2. Loan Payments

When you make forecast loan repayments, you’ll forecast the repayment of the principal in your cash flow forecast. The interest on the loan is tracked in the “non-operating expense” that we’ll discuss below.

3. Purchasing Assets

Similar to how you track sales of assets, you’ll forecast asset purchases in your cash flow forecast. Asset purchases are purchases of long-lasting, tangible things. Typically, vehicles, equipment, buildings, and other things that you could potentially re-sell in the future. Inventory is an asset that your business might purchase if you keep inventory on hand.

4. Other non-operating expenses and sales tax

Your business may have other expenses that are considered “non-operating” expenses. These are expenses that are not associated with running your business, such as investments that your business may make and interest that you pay on loans.

In addition, you’ll forecast when you make tax payments and include those cash outflows in this section.

Forecasting cash flow and cash balance

In the direct cash flow forecasting method, calculating cash flow is simple. Just subtract the amount of cash you plan on spending in a month from the amount of cash you plan on receiving. This will be your “net cash flow”. If the number is positive, you receive more cash than you spend. If the number is negative, you will be spending more cash than you receive.

You can predict your cash balance by adding your net cash flow to your cash balance.

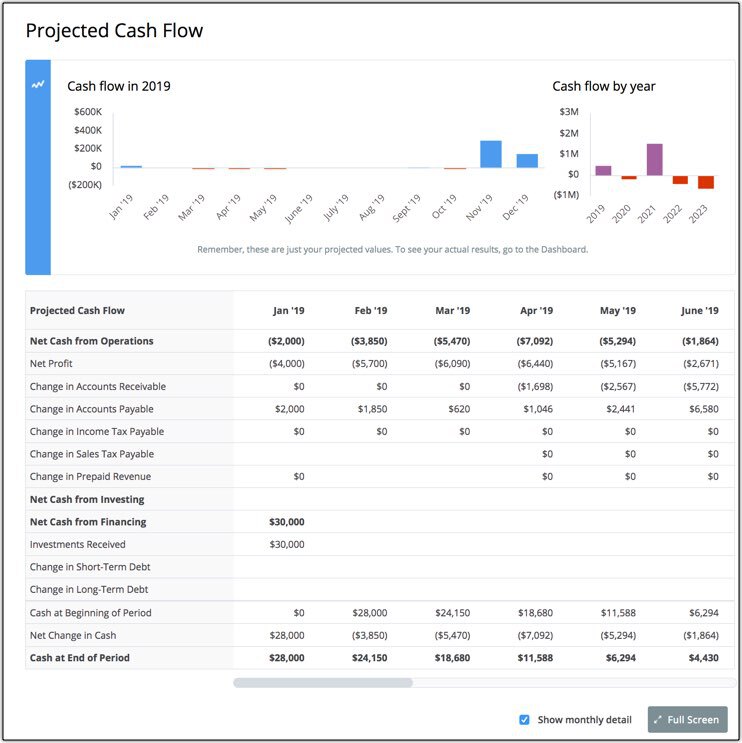

The indirect method

The indirect method of cash flow forecasting is as valid as the direct and reaches the same results.

Where the direct method looks at sources and uses of cash, the indirect method starts with net income and adds back items like depreciation that affect your profitability but don’t affect the cash balance.

The indirect method is more popular for creating cash flow statements about the past because you can easily get the data for the report from your accounting system.

You create the indirect cash flow statement by getting your Net Income (your profits) and then adding back in things that impact profit, but not cash. You also remove things like sales that have been booked, but not paid for yet.

Here’s what an indirect cash flow statement looks like:

There are five primary categories of adjustments that you’ll make to your profit number to figure out your actual cash flow:

1. Adjust for the change in accounts receivable

Not all of your sales arrive as cash immediately. In the indirect cash flow forecast, you need to adjust your net profit to account for the fact that some of your sales didn’t end up as cash in the bank but instead increased your accounts receivable.

2. Adjust for the change in accounts payable

Very similar to how you make an adjustment for accounts receivable, you’ll need to account for expenses that you may have booked on your income statement but not actually paid yet. You’ll need to add these expenses back because you still have that cash on hand and haven’t paid the bills yet.

3. Taxes & Depreciation

On your income statement, taxes and depreciation work to reduce your profitability. On the cash flow statement, you’ll need to add back in depreciation because that number doesn’t actually impact your cash.

Taxes are may have been calculated as an expense, but you may still have that money in your bank account. If that’s the case, you’ll need to add that back in as well to get an accurate forecast of your cash flow.

4. Loans and Investments

Similar to the direct method of cash flow, you’ll want to add in any additional cash you’ve received in the form of loans and investments. Make sure to also subtract any loan payments in this row.

5. Assets Purchased and Sold

If you bought or sold assets, you’ll need to add that into your cash flow calculations. This is, again, similar to the direct method of forecasting cash flow.

Cash flow is about management

Remember: You should be able to project cash flow using competently educated guesses based on an understanding of the flow in your business of sales, sales on credit, receivables, inventory, and payables.

These are useful projections. But, real management is minding the projections every month with plan versus actual analysis so you can catch changes in time to manage them.

A good cash flow forecast will show you exactly when cash might run low in the future so you can prepare. It’s always better to plan ahead so you can set up a line of credit or secure additional investment so your business can survive periods of negative cash flow.

Cash Flow Forecasting Tools

Forecasting cash flow is unfortunately not a simple task to accomplish on your own. You can do it with spreadsheets, but the process can be complicated and it’s easy to make mistakes.

Fortunately, there are affordable options that can make the process much easier – no spreadsheets or in-depth accounting knowledge required.

If you’re interested in checking out a cash flow forecasting tool, take a look at LivePlan for cash flow forecasting. It’s affordable and makes cash flow forecasting simple.

One of the key views in LivePlan is the cash flow assumptions view, as shown below, which highlights key cash flow assumptions in an interactive view that you can use to test the results of key assumptions:

With simple tools like this, you can explore different scenarios quickly to see how they will impact your future cash.

.png?format=auto)